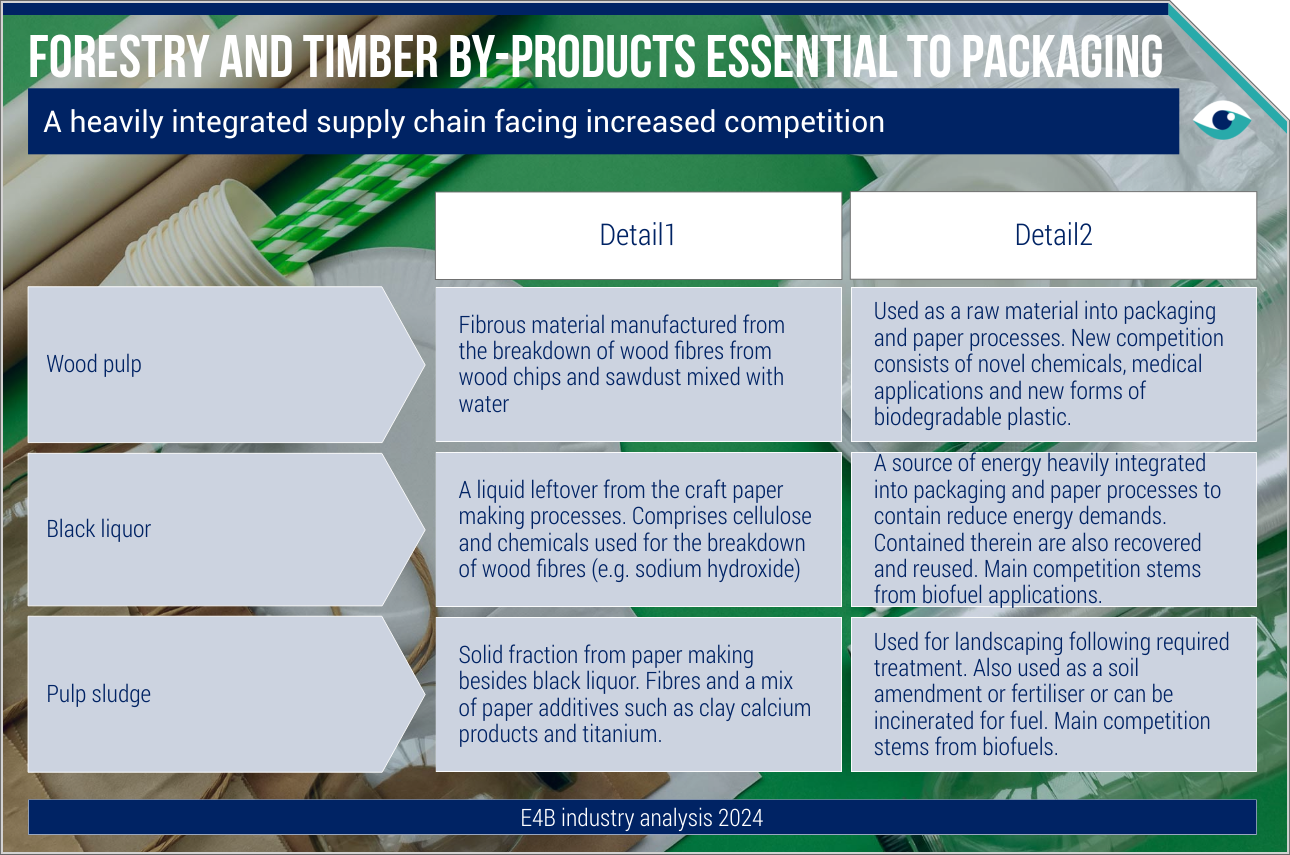

Novel applications may create competition for by-products from forestry and timber processes used in packaging and paper manufacture. This competition arises owing to novel applications such as wood pulp as a PFAS chemicals alternative (“forever chemicals”), for medical applications and as a biodegradable plastic. By-products from sources such as wood pulp have always found use as an input to mainstream paper-based packaging processes owing to fibre needs. In light of this new competition, packaging companies with a dependency on these materials face new risks with respect to margins and operational demands; particularly in terms of financial disclosures.

New wood pulp applications threaten packaging industry

Increasing demand from novel technologies raises material costs and impacts financial disclosures for packaging companies

Value chain: upstream

Packaging

AT A GLANCE

Novel applications for wood pulp, e.g. PFAS chemicals and biodegradable plastics alternatives, may create competition for forestry by-products.

Competition could further immediate risks to profit margins and operational demands for packaging companies.

Long term, businesses may face material shortages and increased IFRS6 and IFRS7 disclosure requirements.

Wood pulp profit margins

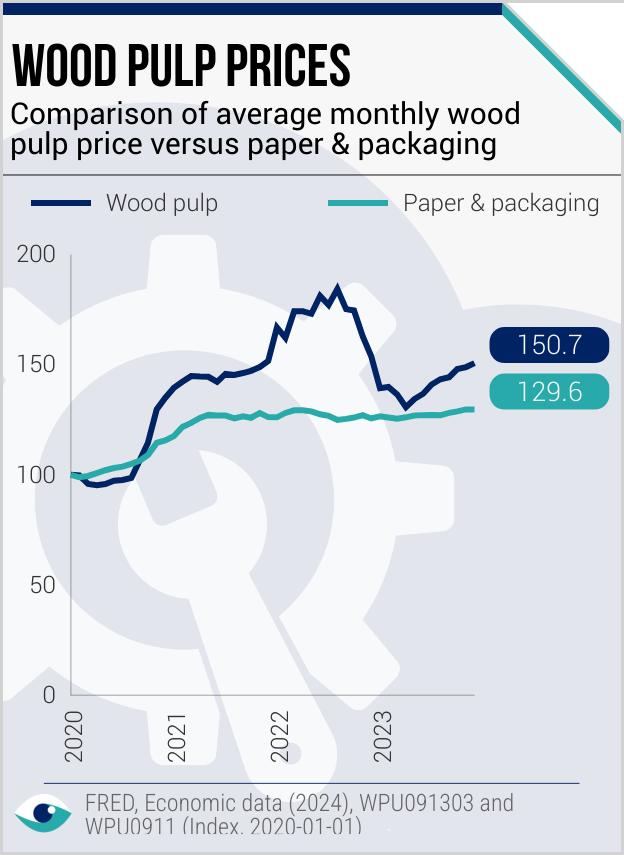

New demand created by exploratory technologies will drive disparity between pulp price and paper price; thus, impacting packaging profit margins. Recent data shows that along with characteristic price volatility, increases in the price of wood pulp can and do exceed those of final products such as packaging or paper (see small chart). The first quarter of 2024 saw rapid unexpected wood pulp price increases. The new demands from novel applications described will only further this divergence in prices.

Demands from biofuels

Wood pulp is not the only by-product from the forestry, timber, packaging and paper supply chain affected by the emergence of novel technologies. Black liquor, the calorific mix of chemicals retrieved from production of wood pulp – used as an energy source in pulp, paper and packaging mills – is being explored for possible diversion into biofuels production. Likewise, pulp sludge – the solid left over from production of wood pulp and extraction of black liquor – is being explored as a biofuel source.

Operational & disclosure

Companies may face long-term material shortages. However, more importantly from an operational point-of-view, companies will need to include the impacts of new material demands as part of disclosure. Specifically, companies will need to include this information under IFRS6 (Resource exploration) detailing changes in cost of goods (COGS) or disruptions to inventory. These developments may also pertain to IFRS7 (Financial instruments) to detail the risk of financial impact from raw material scarcity.

Preparing for scarcity

The rise in demand for wood pulp from novel applications such as biodegradable plastics and medical uses presents significant challenges for the packaging industry. Companies like International Paper and WestRock must address increased costs and price volatility in their financial disclosures, adhering to IFRS6 and IFRS7 standards. This trend underscores the need for proactive resource management and transparency to maintain investor confidence amidst growing material scarcity.

FURTHER READING

- UMaine researchers developing wood-based alternative to PFAS (Maine Public Radio)

- Global pulp prices continue recovery (ResourceWise)

- European consortium pursues black liquor gasification (Biomass magazine)