Technological developments and insatiable demand for hardware have placed an unprecedented strain on the sourcing of critical materials. Recent disruptions in the semiconductor industry serve as a reminder of the fragility of global supply chains. This article examines the upstream value chain of the technology hardware and equipment industry, highlighting challenges to procure tantalum, tin, tungsten (for semiconductors in particular), as well as cobalt and gold (for electronics components) consistent with global standards such as the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

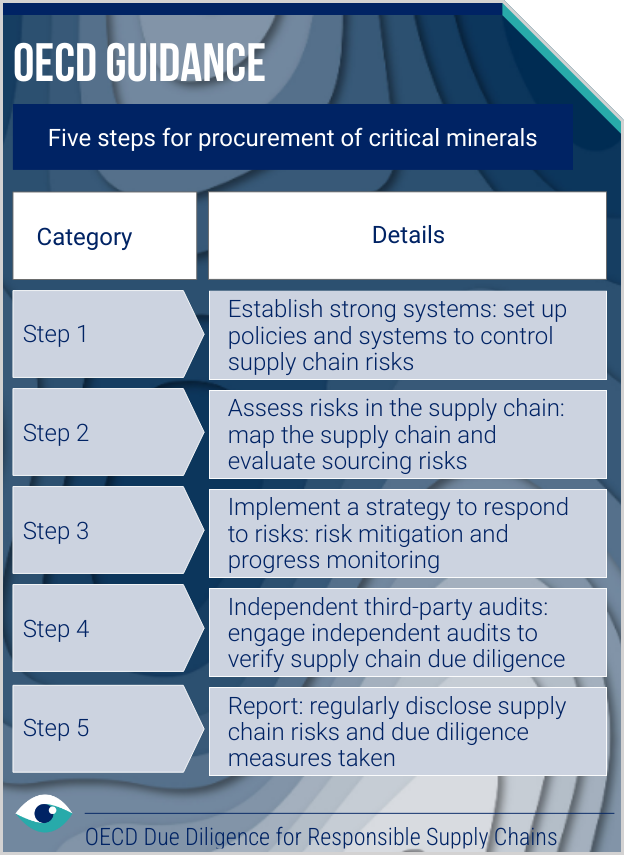

OECD's five steps to responsible upstream procurement

Firms can recognise supply chain risks regarding critical minerals by expanding the scope of existing sustainability-related disclosures

Value chain: upstream

Technology hardware & equipment

AT A GLANCE

OECD guidance is the first example of a government-supported, multi-stakeholder initiative on responsible supply chain management of critical minerals.

Risk arise in mineral supply chains because of circumstances of extraction, trade or handling.

In mitigation, entities can integrate into their systems the OECD's five-step framework for risk-based due diligence.

The 3TG minerals

The 3TG critical materials (tantalum, tin, tungsten and gold), antimony, cobalt and rare earth elements (REE) are essential for the production of semiconductors and electronic devices and often represent a specific supply chain vulnerability for manufacturers. Reserves of these materials are often concentrated in regions fraught with conflict, geopolitical tensions and ethical risks. These include supply chain disruptions, price volatility and reputational damage associated with a perception of unsustainable procurement practices.

Leading public frameworks

In response to risks, setting concrete, measurable targets and transparent reporting becomes paramount. Reporting entities can choose to adhere to the SEC's conflict minerals rule and the EU's Conflict Minerals Regulation. Disclosures should not only list risks but also describe strategic approaches employed to manage them, including engagement with responsible sourcing initiatives like the Responsible Minerals Initiative (RMI) and compliance with the OECD Guidance.

The OECD's five steps

The OECD's guidance recommends the integration of a five-step framework for risk-based due diligence into corporate governance structures. This includes establishing strong internal management systems to identify and assess risks in the supply chain and supply chain due diligence, including conducting independent third-party audits. Particular emphasis is also placed on public disclosure of actions taken. Leading examples include Apple, achieving an industry first with a battery containing 100% responsibly sourced key minerals, and Nvidia, which has committed to sourcing only from conflict-free refiners and smelters.

Opportunities for advantage

Alongside supply chain risks, an opportunity emerges for proactive entities to to demonstrate resilience and responsibility in the industry's upstream value chain. By embracing rigorous due diligence, transparent reporting and proactive engagement with global standards, especially those of the OECD, firms can turn sustainability into a competitive advantage.