Amid a global climate crisis, the conversation around sustainable practices has taken centre stage, especially with COP28 having made food and agriculture systems an area of policy focus. As a top emitter of greenhouse gases, with food loss and waste accounting for 8–10% of global emissions, the food and beverage sector is under scrutiny. Against this backdrop, the sector is called to innovate, comply with emerging regulations, and also align practices with growing consumer demand for sustainability. Embracing advanced sustainable waste management practices represents environmental impact and ensuring a waste-free future.

The path to a waste-free future

Embracing circular economy and producer responsibilities for environmental impact mitigation

Planet: Environmental impacts

Food & beverage manufacturing

Publication date: 01 Jul 2024

By Xarina David

AT A GLANCE

Food waste accounts for 8–10% of global emissions.

Leaders adopt Extended Producer Responsibility (EPR) as they gear towards zero waste goals.

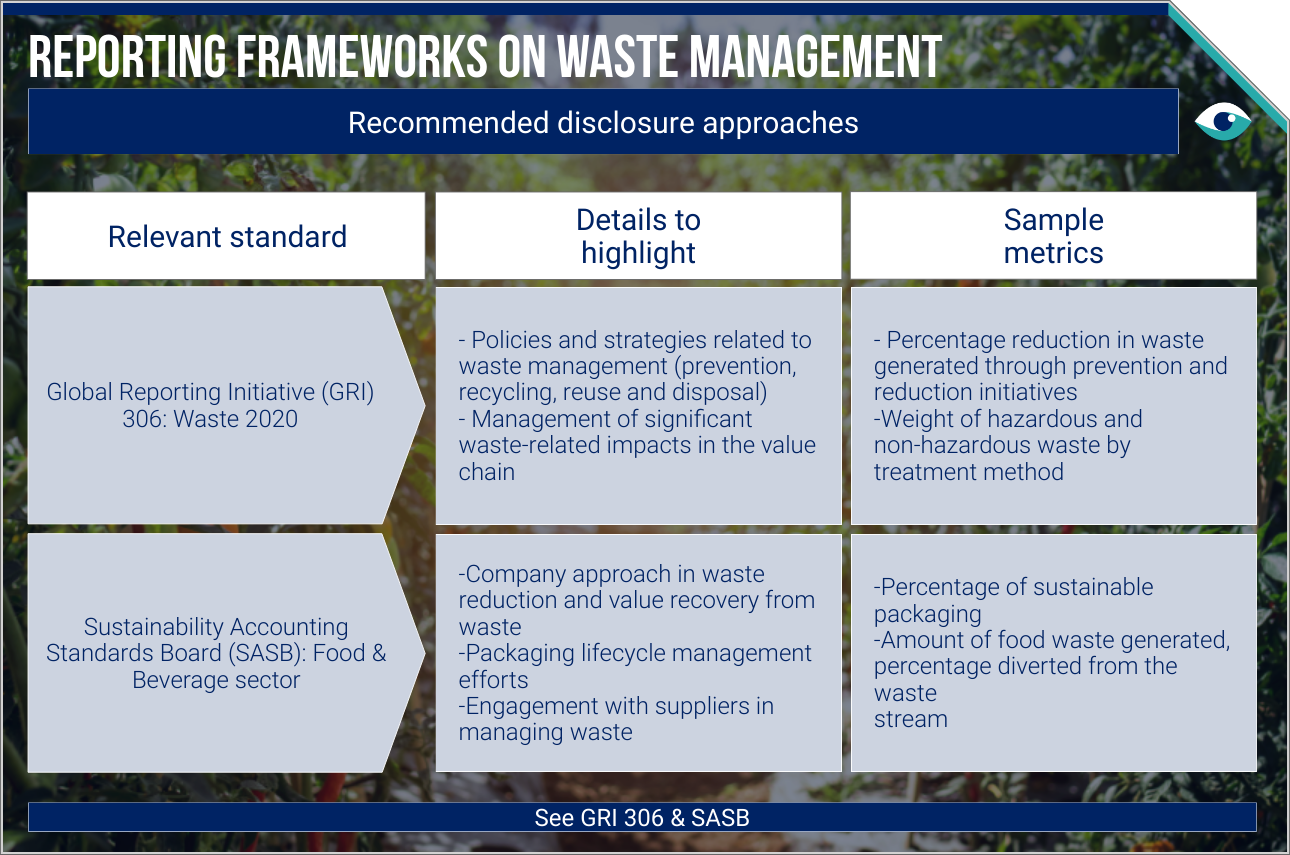

Innovations in recycling and packaging are poised to transform waste management, and disclosures according to GRI 306 and SASB standards for Meat, Poultry & Dairy, and Processed Foods will bring more transparency.

Extended responsibility

Extended Producer Responsibility (EPR) is a policy approach that gives producers significant financial and physical responsibility for treating or disposing of post-consumer products. For food and beverage manufacturers, this involves waste collection, processing, recycling and innovation to create recyclable packaging and reusable products. Food manufacturers like Unilever commit to EPR by aiming for fully recyclable packaging and incorporating recycled materials to reduce plastic waste.

Circular economy goals

The circular economy model is a cornerstone of sustainable waste management, aiming to keep resources in use for as long as possible. Unilever's goals for a waste-free future include making its plastic packaging 100% recyclable, reusable or compostable by 2025 and halving its food waste. Similarly, PepsiCo's End-to-End (E2E) Materials Waste Program demonstrates a comprehensive approach to managing waste across its value chain, striving for zero waste to landfill in its direct operations.

Supply chain optimisation

Manufacturers like Nestle leverage technology to optimise supply chains to ensure efficient resource use and waste reduction. By improving demand forecasting and inventory management, Nestle addresses waste at its source. It also applies a supply chain approach, from raw materials to consumer delivery. On the other hand, Kraft Heinz collaborates with external partners like Northstar Recycling to develop recycling solutions to reduce virgin plastic use by 20% by 2030.

Industry implications

Eco-friendly credentials are becoming essential for companies to sustain and grow market share. With this connection, sustainability has become a key market differentiator. A broad market shift in favour of circular economy practices is expected to make sustainable options more available and affordable. To maintain advantage, companies must transparently communicate adherence to standards like GRI 306: Waste and the SASB standards for Meat, Poultry & Dairy, and Processed Foods.

FURTHER READING

- Local solutions to reducing waste (World Economic Forum)

- Food waste emissions (World Economic Forum)

- COP28 Food waste solutions (NRDC)