In December 2023, at the 28th Conference of the Parties (COP) to the UN Framework Convention on Climate Change, countries failed to agree on updates to the Paris Agreement on climate change, greenhouse gas removal and carbon credit methodologies. Many companies are already pursuing carbon capture projects, but commercial viability, scalability and ability to deploy concerns deter others. A favourable consensus at the 29th COP can ensure such projects earn carbon credits, and attract more investment, technological tie-ups and government support, hastening their deployment in the coal industry and expanding the role they play in reaching net-zero emissions.

Coal-based operations embrace carbon capture solutions

The technologies are costly but limit energy-security threats, and climate-related financial, physical, regulatory and reputational risks

Planet: Environmental impacts

Hydrocarbons

Publication date: 09 Aug 2024

By Nitin Koshi

AT A GLANCE

Coal-based power, iron, steel, cement and chemical companies are adopting carbon capture and storage (CCS) and carbon capture, utilisation and storage (CCUS) technologies.

More public and private investment, technology tie-ups and policy support are necessary to improve carbon capture’s viability.

Beyond oil recovery, uses for captured carbon dioxide (CO2) will be developed.

High costs

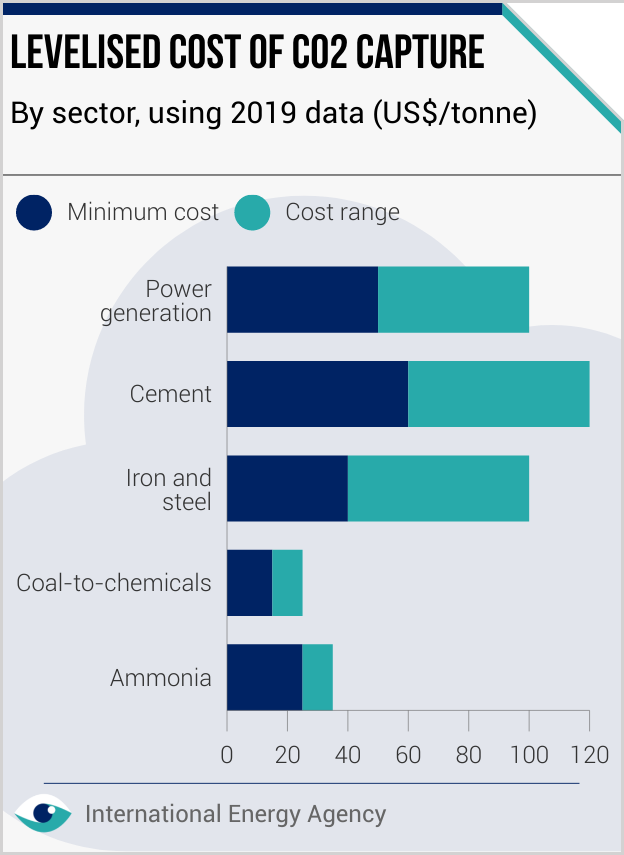

The International Energy Agency, a forecaster, says levelised CO2 capture costs vary in power (USD 50 to USD 100 per tonne), cement (USD 60 to USD 120 per tonne), iron and steel (USD 40 to USD 100 per tonne), and coal-to-chemicals (USD 15 to USD 25 per tonne) production. BloombergNEF, a research firm, says CO2 transport and storage fees range from USD 20 to USD 50 per tonne. So far, only four carbon-capture coal power projects, including China Shenhua Energy Company Limited’s Jinjie plant, are operational.

Government support

State support – such as via the EU’s Innovation Fund, which awards grants for deploying low-carbon technologies, and the US’s Inflation Reduction Act, which incentivises CCS and CCUS technologies – can spur development of scalable carbon-capture technologies and curb project costs. The Australian government has awarded Glencore plc AUD 35 million for an AUD 210 million local project, which awaits environmental approval, to test inject and store CO2 captured from the Millmerran coal power plant in the Surat Basin.

Collaboration

Tie-ups nurture innovation. BHP Group Limited and major steelmakers – HBIS Group Co Ltd, China Baowu Steel Group Corporation Limited, POSCO Holdings Inc, Tata Group and ArcelorMittal SA and Mitsubishi Group – have partnered to expand their carbon capture capabilities, such as via low-carbon blast furnace operations. Sasol Limited and Arcelor Mittal are jointly developing technology to convert carbon captured from South Africa's Vanderbijlpark steel plant into sustainable fuels and chemicals.

Hubs and clusters

Developing carbon-capture hubs and clusters to connect CO2 emitters, including coal-based power, iron and steel, cement, and chemical producers, via shared infrastructure can spread transport and storage costs, reduce financing requirements, create economies of scale, utilise captured CO2 in making low-carbon commodities and curb project risks. Plans for carbon-capture hubs, e.g. the UK’s East Coast Cluster and Australia’s CarbonNet project, are advancing globally.

FURTHER READING

- CCUS projects explorer (IEA)

- Paths to commercial liftoff: carbon management (US Department of Energy)

- Energy technology perspectives 2023 (IEA)