IKEA's recent €1 billion green bond issuance for energy efficiency and renewables exemplifies the growing adoption of sustainable finance in the consumer durables sector. This presents opportunities and challenges as entities navigate complex disclosure frameworks while striving to deliver measurable outcomes. Projections indicate the retail sector's green bond market could reach USD 50 billion by 2025, with energy-efficient stores as a focal point. Consumer durables entities should align financing strategies with investor expectations and regulatory requirements through robust frameworks, transparency and measurable improvements in retail operations.

The green bond that built the house

Within the consumer durables sector, green bonds are reaching record volumes, with an increasing focus on energy-efficient stores

Finance

Consumer durables (all industries)

AT A GLANCE

Green bonds present a significant opportunity for consumer durables entities to finance energy-efficient stores and operations.

The market is projected to reach USD 50 billion by 2025, with energy-efficient projects dominating issuances.

Benefits include enhanced sustainability credentials, cost savings and alignment with EU regulations like the European Green Bond Standard.

Green bond frameworks

The EU has established standardised requirements for European green bonds (EuGBs), positioning them as crucial instruments for financing investments in green technologies, energy efficiency, resource optimisation and infrastructure development. The green bond market has witnessed remarkable growth, with issuance across all sectors reaching record levels of USD 273 billion in Q1 2024. This growth is characterised by an increasing diversity of issuers and the evolution of comprehensive guidelines and disclosure frameworks to enhance transparency and market integrity.

Energy-efficient projects

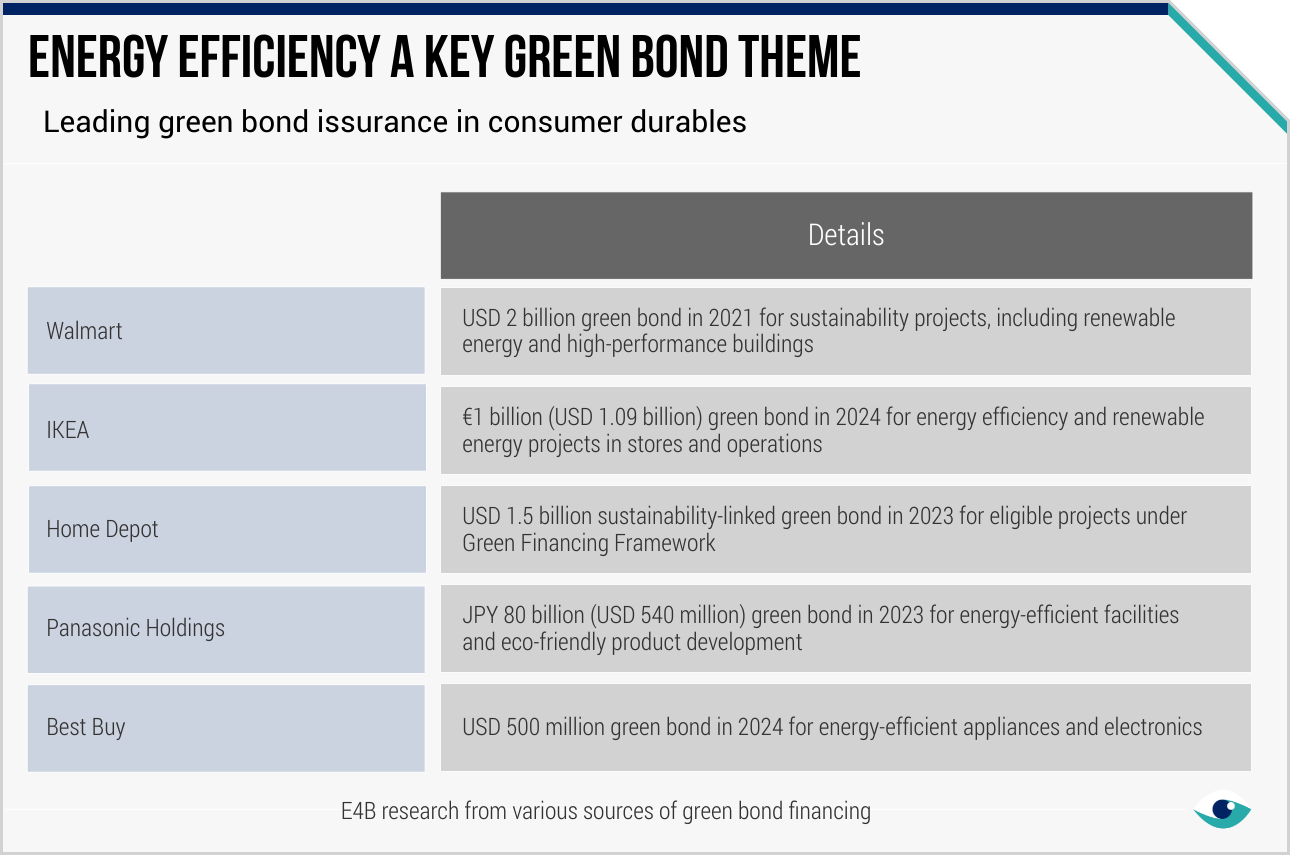

In the consumer durables sector, energy efficiency initiatives in retail stores and operations are becoming a key focus. Major retailers like IKEA, Walmart and Best Buy have issued green bonds to finance energy-efficient appliances, electronics and store improvements. The IFC anticipates that more than 80% of the multi-trillion-dollar climate change investment opportunity in the East Asia Pacific region will be in new green building construction in China. The IFC provides advisory support to develop pipelines for industrial energy-efficient and green building transactions.

Emerging market green bonds

In the Global South, the issuance of over 20 green bonds across 13 African nations demonstrates the increasing adoption of this financing mechanism in emerging markets. However, negligible finance has been directed to energy efficiency in buildings, and the public sector dominates green bond issuance across the continent. Sovereigns and development banks are leading the market and establishing frameworks for higher corporate participation beyond an established focus on agriculture, water and transport.

Other green use of proceeds

Best Buy, the first major US electronics retailer to enter the green bond market, has introduced a USD 500 million green bond initiative to fund energy-efficient appliances and electronics. The Home Depot, the world's largest home improvement retailer, has priced a USD 1.5 billion green bond to fund eligible green projects more generally.

FURTHER READING

- Green Bonds: State of the Market 2023 (Climate Bonds Initiative)

- Sustainable Finance Disclosure Regulation (European Commission)

- Building Green: Mapping Energy Efficiency dataset (World Bank)