The EU Deforestation-Free Regulation (EUDR), mandating that any operator importing or exporting commodities like palm oil must prove that the products don’t originate from deforested land or contribute to forest degradation, pressures consumer goods organisations to shift to sustainable sourcing. According to a UN Food and Agriculture Organisation (FAO), 7% of global deforestation between 2000 and 2018 can be attributed to oil-palm plantations alone (more recent data indicates closer to 10%). Consumer organisations should consider the implications of the EUDR on due diligence and brace for more regulatory scrutiny and the risk of fines for non-compliance.

Going beyond certifications for sustainable palm oil

Compliance with EUDR will require organisations to leverage certifications but also enhance supply chain sustainability initiatives

Policy

Consumer durables (all industries)

Publication date: 30 Sep 2024

By Eye For Business

AT A GLANCE

The EU Deforestation-Free Regulation compels organisations to adopt sustainable practices and source deforestation-free palm oil.

Palm oil was linked to about 7% of global deforestation between 2008 and 2018.

Deforestation certification schemes can help organisations align with EUDR in part, but they need to prepare for supply chain-related due diligence frameworks.

Environmental risks

Deforestation certification schemes like the Roundtable on Sustainable Palm Oil (RSPO) can facilitate their members' compliance with EUDR requirements in part. The largest palm oil producers, Indonesia and Malaysia, have mandatory certification schemes too, like the Indonesian Sustainable Palm Oil (ISPO) and the Malaysian Sustainable Palm Oil (MSPO), aimed at improving sustainability performance. As the EU works with Malaysia, the MSPO certification could potentially serve as a tool for compliance with EUDR.

Environmental risks

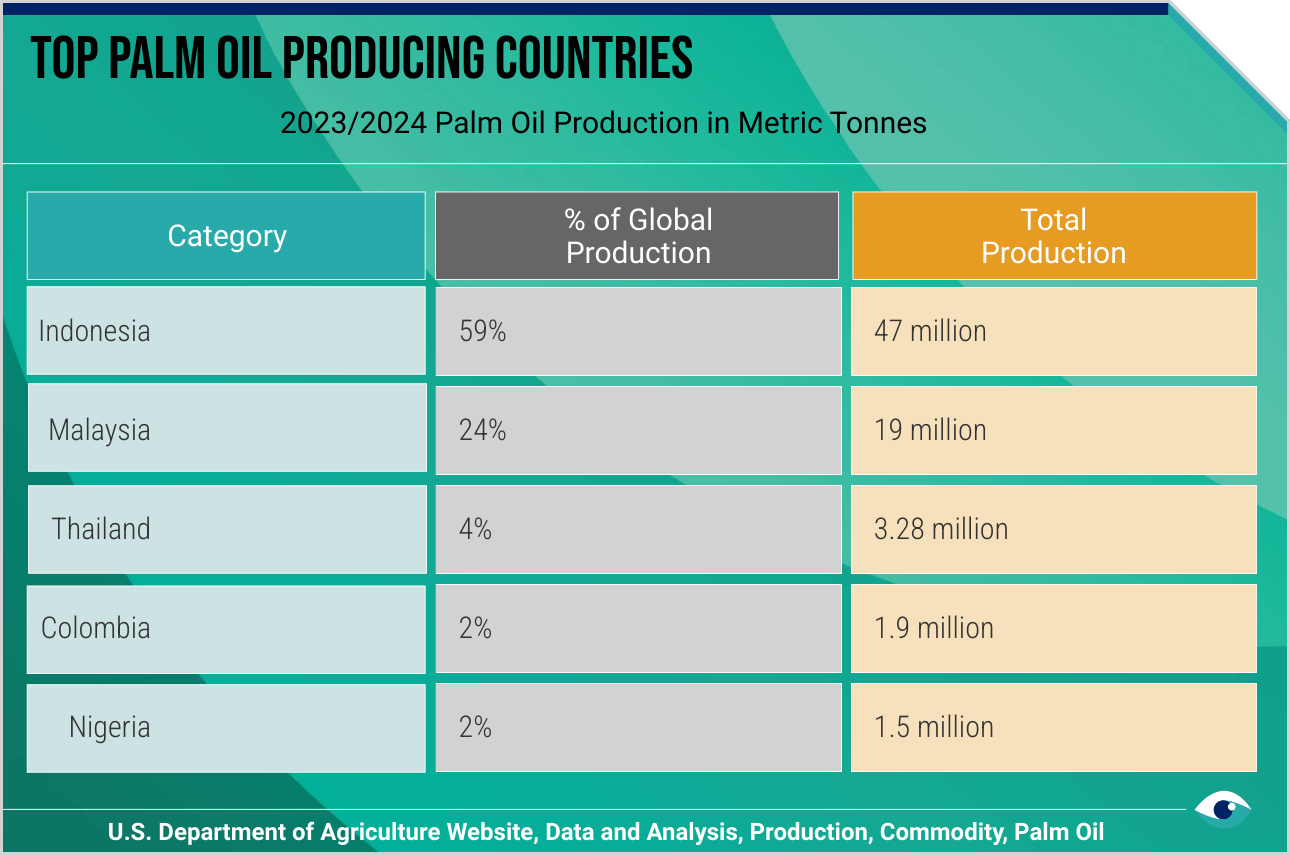

The major environmental risk related to palm oil production is deforestation. Found in a range of products, including shampoo, body lotion, and packaged foods, palm oil production jumped to 74.7 Mt in 2020, compared to about 42.6 Mt in 2008 and production has continued to match demand. More land is required for palm oil production to keep up with booming demand. While oil palms can be planted on degraded land or land used for other crops previously, 45% of the land area used by new plantations was forested land.

Traceability and transparency

The EUDR requires supplier screening using due diligence frameworks, making it important for organisations within the scope of the regulation to start preparing immediately. Consumer goods giant Unilever has been investing in technology and infrastructure to make its supply chain more sustainable, besides cutting down the number of mills it buys from and moving to lower-risk locations. The organisation is also engaging more with smallholders and independent mills to enhance visibility and traceability across the supply chain.

Supply chain sustainability

As regulation becomes stricter, businesses are investing in sustainable palm oil practices which will help them in the longer term. In collaboration with the Rainforest Alliance and food wholesaler METRO, supermarket chain Sainsbury's invested in an initiative in Sintang (Indonesia) to help promote integrated landscape management aimed at addressing production issues and supporting smallholders in producing sustainable palm oil.