As scrutiny on the impact of the mining sector grows with an increased focus on the responsible supply of minerals, the new Global Reporting Initiative's (GRI) 14 standard aims to support miners in fulfilling crucial disclosure and due diligence requirements. It requires miners to report on key areas, including emissions, waste, biodiversity, water usage, corruption and overall impact on communities and the environment, helping them communicate their impact meaningfully to stakeholders. However, it will require mining organisations to engage more with their suppliers to identify emissions hotspots and incentivise them to adopt mitigation initiatives.

GRI 14 to improve mining firms’ sustainability reporting

The new standard is designed to enable consistent environmental reporting across the sector with a comprehensive set of metrics

Policy

Materials (all industries)

Publication date: 30 Sep 2024

By Eye For Business

AT A GLANCE

The new GRI 14 standard will enable consistent disclosures across mining organisations as stakeholder demand for information about the impact of the sector grows.

Accessing data and addressing emissions bottlenecks across complex, multi-layered supply chains will be challenging for miners.

Miners should focus on scenario analysis for long-term planning and risk mitigation.

Navigating supply chains

With complex, multi-layered supply chains and poor data availability, it is challenging to address emissions-data bottlenecks, but miners are taking different approaches to address such issues. Rio Tinto, which works with 20,000 suppliers, notes in a climate disclosure, it is taking a systematic approach to engaging with suppliers as part of efforts to reduce upstream Scope 3 emissions from procurement. The Anglo-Australian miner is initially prioritising 50 of its highest-emitting suppliers representing about 40% of its procurement-related emissions.

Responsible sourcing

Mining accounts for 4–7% of global emissions in terms of Scope 1 and 2 emissions; including Scope 3 emissions links the sector to about 28% of total emissions. The International Renewable Energy Agency (IRENA) notes about 54% of energy transition minerals are found on or near indigenous peoples’ land, highlighting the need for responsible sourcing through adopting sustainable procurement processes (integrating environmental, social and cost considerations) and establishing responsible sourcing programmes.

Addressing regional risks

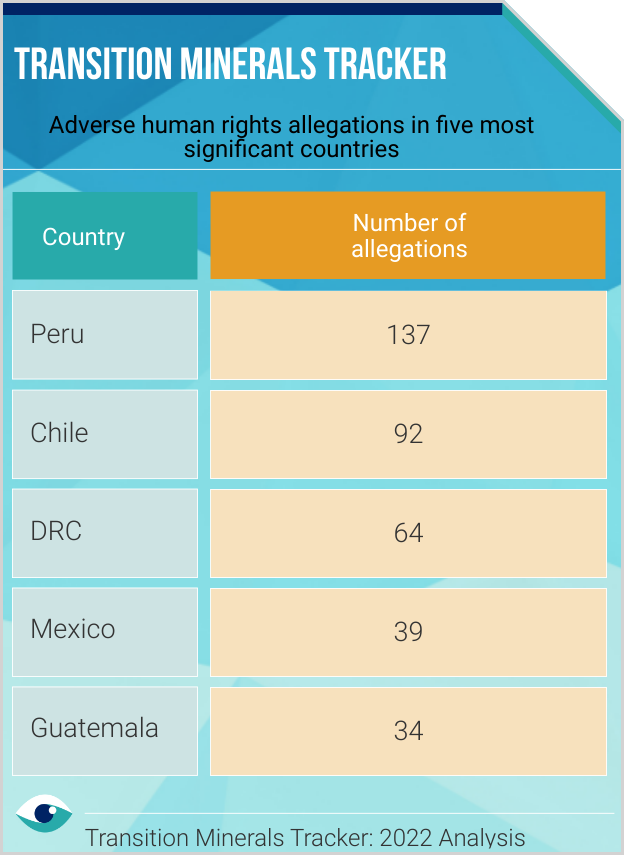

London-based Business and Human Rights Resource Centre's Transition Minerals Tracker, monitoring human rights cases associated with large-scale mining operations of key minerals, tracked 631 allegations between 2010 and 2023, underscoring the magnitude of risk faced by the mining sector. Transition minerals are often extracted from regions facing political instability and human rights-related criticism in the Global South, making GRI 14 disclosures crucial for supply chain transparency by leading reporting entities.

Long-term strategies

GRI 14 comes into effect in 2026, but organisations should also take the long view on sustainability. Anglo American uses scenario analysis for long-term planning and risk mitigation. The miner, which reported its first scenario analysis in 2021 and committed to revise it every two years, has used the TCFD and the International Energy Agency's three scenarios to form the baseline to develop its scenarios.