Shipbuilding entities are concentrated in a few key regions with the European Union (EU) being the world’s largest supplier of marine equipment, followed by Korea, China and Japan. Constructing a vessel requires over 550,000 parts and significant coordination, highlighting disruption risks from overreliance on specific manufacturers. Additionally, the maritime industry faces pressure to decarbonise in response to the International Maritime Organisation’s (IMO) Greenhouse Gas (GHG) strategy. The demand for highly specialised, custom-made parts further amplifies risks associated with supply chain disruptions, counterfeits and decarbonisation policies.

Maritime supply centred in few key regions

Overreliance on specific suppliers poses disruption risks, heightened by counterfeit concerns and decarbonisation initiatives

Value chain: upstream

Shipping

AT A GLANCE

The EU, Korea, China and Japan dominate global shipbuilding, driving high demand for specialised marine parts.

Supply chain risks and counterfeit parts challenge the industry amid strict environmental and decarbonisation efforts.

Supplier diversification and the adoption of 3D printing enhance supply chain resilience.

Global dynamics

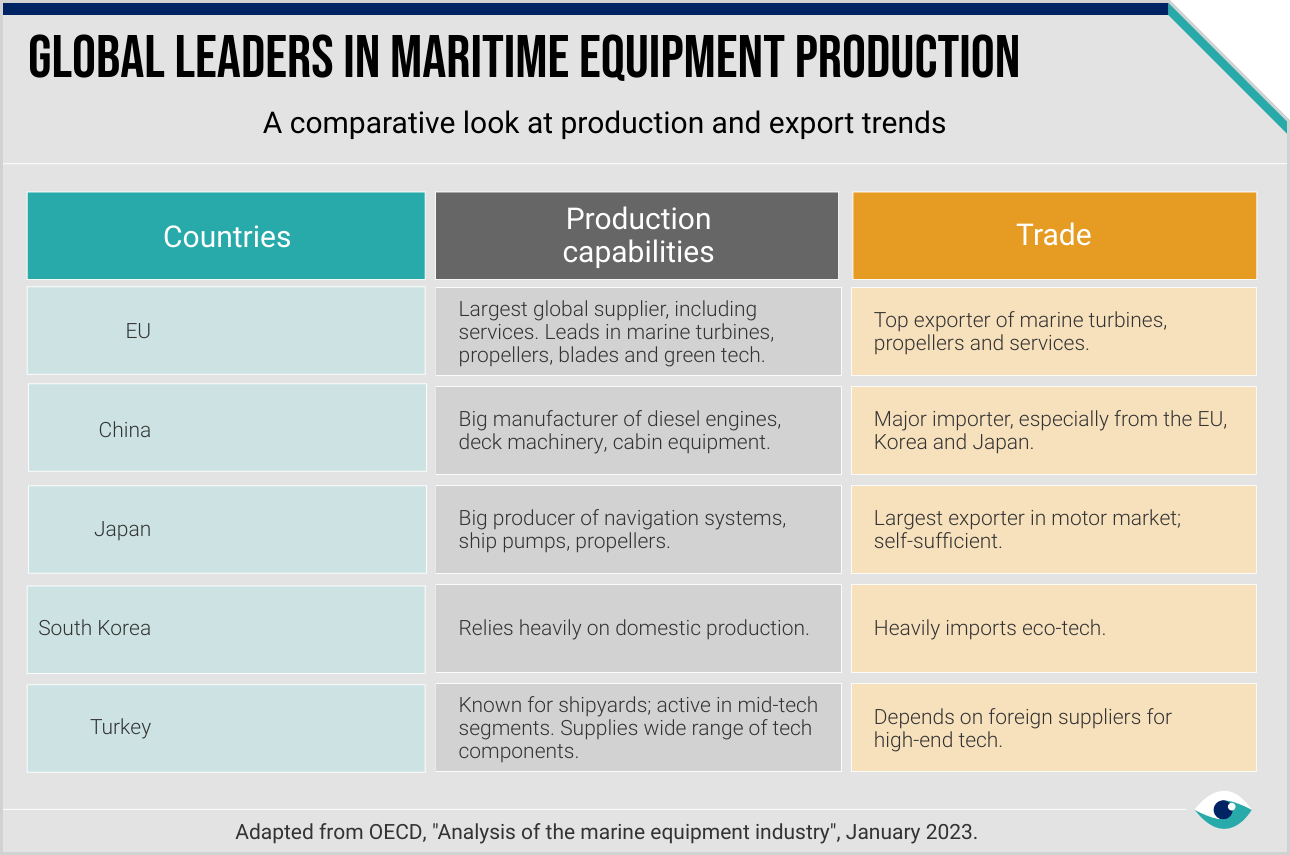

The shipbuilding industry is concentrated in a few regions, with the EU, Korea, China and Japan dominating as major producers and suppliers of marine equipment. The EU leads in exporting advanced maritime technologies, while Japan excels in the outboard motor market. Dependencies are clear as China and Korea import high-tech products like marine diesel engines and propellers. This highlights a complex network of material flows, with a need for strategic management amid geopolitical and regulatory challenges.

Supply chain risks

Reliance on a limited number of suppliers exposes shipbuilders to supply chain disruptions and increased operational costs. Guided by the GRI 308 standard, organisations are pressured to mitigate these risks through supplier diversification and adopt sustainable procurement practices. Counterfeit parts add complexity to maintaining quality and compliance. Environmental regulations requiring adherence to the IMO decarbonisation goals amplify the push towards sustainable sourcing.

The twin transition

The maritime industry is actively embracing the ‘twin transition’ – the simultaneous adoption of digitalisation and decarbonisation – with the EU leading as the main producer of green and digital technologies. CMA CGM and Maersk are leveraging 3D printing to produce parts more quickly, cheaply and in many cases locally, reducing extensive inventories and mitigating risks associated with counterfeit parts. These advancements, with strategic supplier diversification and audits, enhance supply chain resilience.

Future outlook

As the maritime industry increasingly implements highly digitalised components, the demand for skilled labour intensifies. In addition, in pursuit of net-zero goals, the focus on using environmentally friendly materials like steel and aluminium increases. Recycled steel, for instance, is becoming a valued raw material. Initiatives like the Climate Group's SteelZero are critical, as they bring together leading organisations to accelerate the transition to a net-zero steel industry.